|

|

OCTOBER 14

Anfield club's future to be

decided in Dallas court on Friday

By Paul Kelso - Telegraph.co.uk

New England Sports Ventures’ prospects of taking

control at Anfield before Sunday’s Merseyside derby rest on the verdict

of a Texan judge expected to reveal whether the much-delayed deal can

proceed after 1pm UK time on Friday.

Representatives of NESV and RBS, whose loans of £245 million to

Liverpool become due at the close of business on Friday, petitioned the

Dallas District Court on Thursday night in the hope that the court would

hear an application to remove the order.

Liverpool’s current owners, Tom Hicks and George Gillett, who was said

to be in London on Thursday night consulting his lawyers, secured the

Temporary Restraining Order (TRO) late on Wednesday night to frustrate

NESV’s efforts to take control.

Should the last-ditch efforts in Dallas

succeed, a deal could be sealed on Friday, but were they to fail or be

delayed Liverpool’s fate is likely to remain uncertain over the weekend,

when they face Everton in the Merseyside derby.

If the Dallas proceedings founder a delay until Monday is likely,

despite Hicks and Gillett suffering a second High Court defeat in 24

hours on Thursday afternoon.

A day after dismissing the Americans’ request for an injunction to halt

the sale, Mr Justice Floyd ordered Hicks and Gillett to withdraw the

TRO. Describing Hicks and Gillett’s conduct as “unconscionable” and

arguing that Liverpool’s fate had “nothing to do with Texas”, the judge

granted RBS’s request for a rare ante-suit injunction requiring the

Americans to remove the TRO.

The ruling was potentially undermined, however, by the judge’s decision

to grant Hicks and Gillett until 4pm BST today to comply with the order,

too late for the sale to be completed before the weekend. NESV’s

counsel, David Chivers QC, told the court the sale could only be

completed today if an order to transfer funds was given before 3pm.

With Hicks and Gillett not represented in court, there is little

expectation that they will comply with the order, and even if they do it

is predicted to be at the last minute.

Given those circumstances, the club would remain in limbo through the

weekend, overshadowing a game that already has season-defining potential

for both clubs.

Should the deal not go through RBS will finally face the decision that

it has spent the last three days in court trying to avoid: what to do if

the loans are not repaid on time.

Having pressed so hard to secure the NESV deal in the last two weeks,

the bank is not expected to tip Liverpool’s holding company into

administration if the deal is not done, though it spent a considerable

portion of Thursday’s hearing arguing that the TRO should be lifted so

it had the power to do so.

If the loans are left hanging though, it will increase the sense of

anxiety around the club. Were Hicks and Gillett to find a way of paying

off the RBS debt, Liverpool chairman Martin Broughton would no longer

have the power to choose the club’s next owner. Other buyers including

Mill Financial, the US hedge fund that now controls Gillett’s 50 per

cent stake, are said to be interested.

While RBS remains the major lender, it would only be able to reverse

into the club if Broughton approved the sale of Hicks’s stake.

The High Court hearing underlined the desperate and cynical nature of

Hicks and Gillett’s attempts to remain in control, and ended in another

resounding defeat.

The court heard that for the second time in eight days the sale of the

club was approved to NESV at the board meeting on Wednesday night and

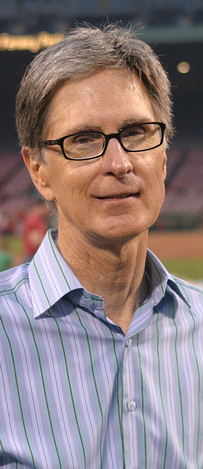

attended by John W Henry. For the second time, however, the sale was

frustrated.

Chivers told the court that NESV now considered itself “the Owner,

capital O”, adding: “The owners from beyond the grave are seeking to

exercise with their dead hand a continuing grip on this company.”

Counsel for RBS, Liverpool’s English directors and NESV took turns to

attack the TRO and the accusations contained in the 28-page petition

that accompanied it.

In it Hicks and Gillett made a series of lurid allegations, accusing the

English directors of plotting against them, frustrating their attempts

to refinance the club, briefing confidential information to the media

and seeking to sell the club for less than its value while negotiating

personal bonuses of more than £250,000 each.

They also made the very serious allegation that RBS had abused its

position as “a world banking leader” by writing to potential investors

telling them that no offer that gave Hicks and Gillett a return on their

equity would be entertained.

Richard Snowden, QC for RBS, described this as “poppycock”, while Lord

Grabiner, for the club, described the owners as “abusive, vexatious,

oppressive and incorrigible”.

The hearing was also told that, as it sat, Hicks and Gillett had sought

an order in Texas for contempt of court against Broughton and his fellow

English directors.

“It apparently demands that they be jailed until they clear themselves

of their contempt,” Lord Grabiner said. Last night that case was

understood to have been adjourned.

One complication was eased, when Peter Lim said he was withdrawing,

having had a £325 million offer for the club rejected on Wednesday.

LIVERPOOL’S TRANSATLANTIC TRIALS

Wednesday, London

RBS v Hicks and others

High Court finds in favour of RBS, Broughton and NESV, orders Hicks and

Gillett to restore the holding company board in order to allow sale.

Justice Floyd also rejects injunction from Hicks and Gillett seeking to

block sale

Wednesday night, Dallas

Hicks and Gillett v NESV, RBS and the “English directors”

Judge Jim Jordan issues temporary restraining order preventing sale of

club and suing for £1bn in damages. Trial date set for Oct 25.

Thursday, London

RBS v Hicks and Gillett II

The bank, supported by Liverpool’s independent directors and NESV, seeks

an “ante-suit injunction” requiring the Americans to withdraw the Texan

court order. Mr Justice Floyd grants it.

Thursday afternoon, Dallas

Hicks and Gillet v NESV, RBS and the “English directors” II

The American’s counter alleging that Wednesday night’s board meeting to

ratify the NESV deal, which they attended by phone, was a contempt of

court and arguing those attending could be jailed.

Thursday night, Dallas

NESV and RBS and the English directors v Hicks and Gillett

The owners-in-waiting seek to overturn the restraining order. Case

adjourned until 1pm BST, 7am in Dallas.

Oct 21, London

NESV and LFC have agreed to seek a declaratory judgment approving the

sale if all else fails.

OCTOBER 14

High

Court rules

against Reds owners

TEAMtalk

Liverpool again moved to the brink of new ownership

after a High Court judge dismissed an injunction preventing the sale of

the club.

Mr Justice Floyd criticised Tom Hicks and George Gillett as he granted

anti-suit injunctions in a bid to nullify decisions taken in the court

in Dallas.

The judge said he had given a ruling in London on Wednesday that meant

the English directors of Liverpool could agree a £300million takeover by

John W Henry's New England Sporting Ventures (NESV).

But before the board could make any decision, Tom Hicks, one of the

American owners, secured a temporary restraining order from the Texas

court.

Mr Justice Floyd said that, on the face of it, that amounted to

"unconscionable conduct on the part of Mr Hicks and Mr Gillett".

Mr Justice Floyd said his mandatory orders were not aimed at the Texas

court but Hicks and Gillett to stop them taking further action there and

to nullify any orders obtained in Dallas.

David Chivers QC, who told the judge that his clients, NESV, already

considered themselves the new owners of Liverpool, asked the judge for a

speedy serving of his orders on Hicks and Gillett so the deal with NESV

can be completed and money transferred from the US.

He said if the deal was not completed on Friday, then Hicks and Gillett

had succeeded in stopping the sale of Liverpool before repayment of the

debt to RBS became due.

The judge gave Hicks and Gillett until 4pm on Friday to comply with his

orders.

"The owners' behaviour conclusively demonstrates just how incorrigible

they are.

"They are absolutely determined to stop this transaction in its tracks

and they have no lawful justification for behaving in this way."

He added: "This is unconscionable behaviour of the worst possible kind

and they are probably sitting there giggling."

Mr Chivers told the judge that NESV "are the owners of Liverpool now".

He described Hicks and Gillett as "the owners from beyond the grave who

are seeking to exercise with their dead hand a continuing grip on this

company.

"That is simply not acceptable."

Liverpool issued a statement on behalf of Broughton, Purslow and Ayre.

"The independent directors of Liverpool Football Club are delighted with

the verdict of Mr Justice Floyd in the High Court this afternoon which

now requires Mr Hicks and Mr Gillett to withdraw their Texas restraining

order by 4pm tomorrow," it said.

"We are glad to have taken another important step towards completing the

sale process."

OCTOBER 14

Lim withdraws Reds

offer

Sky Sports

Singapore billionaire Peter Lim has withdrawn his

interest in gaining control of Liverpool.

Lim made his bid for the Liverpool public this week just as the club

were entering a High Court Case against current owners Tom Hicks and

George Gillett.

Liverpool agreed a sale with prospective buyers New England Sports

Ventures, but Lim trumped their £300million offer by tabling £320million

with an extra £40million on top for Roy Hodgson to spend on players in

the January transfer window.

The ownership of Liverpool is up in the air with the proposed

£300million deal with NESV delayed on Wednesday after Hicks and Gillett

gained an injunction in a Texas court to stop the sale of the Anfield

outfit.

Hicks and Gillett won the restraining order after the High Court in

London ruled the American duo could not prevent a change of ownership.

No response

Lim has now left the path clear for NESV to secure control of Liverpool

if they overturn the injunction after revealing Liverpool's board and

RBS bank have "chosen not to respond or to discuss" his offer for the

club.

"It has become clear to me that the Board is intent on selling the club

to New England Sports Ventures (NESV) to the exclusion of all other

parties, regardless of the merits of their bids," Lim said in a

statement.

"In these circumstances, I am not able to proceed with my intention to

acquire the club."

OCTOBER 14

Hicks

quashes Mill Financial

'takeover deal' rumours

By Luke Traynor - Liverpool Echo

Liverpool co-owner Tom Hicks has not sold his shares

to Mill Financial, the American's spokesman claimed today.

He insisted the Texan remained in control of his 50% stake in the club,

as the future of the Reds remained mired in confusion.

Mill Financial, an arm of US hedge fund Springfield Financial Company,

based in Virginia, has reportedly done a deal with Mr Hicks to buy his

shares at Anfield.

But in the last 15 minutes, a spokesman claimed there was no truth to

those reports, although he would not expand further on Mr Hicks' or Mill

Financial's position.

The Virginia company already have an interest in Liverpool after

co-owner George Gillett defaulted on his £75m loan with the same company

two months ago.

It comes as the continuing saga of the ownership of the Reds was heard

before the High Court this morning.

The English-based Anfield directors, along with the Royal Bank of

Scotland and prospective buyers of the club New England Sports Ventures,

were hit by a massive $1.6b law suit by Tom Hicks and George Gillett

late last night.

The sale, agreed with the Boston consortium last night, was put on hold

pending legal clarification of the temporary restraining roder.

This morning, the Judiciary confirmed to the ECHO the club's challenge

against that court order, made in Texas, was heard briefly at the Royal

Courts of Justice.

A further hearing will take place from 2pm today when Mr Justice Floyd

will hear the application to overturn the lawsuit in full.

OCTOBER 14

Keep the

faith, roars Broughton

TEAMtalk

Martin Broughton remains confident the takeover of

Liverpool will go through despite Tom Hicks and George Gillett's bid to

block the sale.

The proposed £300million deal with New England Sports Ventures (NESV)

was delayed on Wednesday after the club's current owners Hicks and

Gillett gained an injunction in a Texas court to stop the sale of the

Anfield outfit.

Earlier on Wednesday a takeover looked to be on the horizon after the

High Court in London ruled Hicks and Gillett could not prevent a change

of ownership.

The whole process took another step closer on Wednesday evening when

NESV supremo John W Henry, who also controls the Boston Red Sox, then

arrived in London for talks with Liverpool's board

However, Hicks and Gillett have challenged the sale by obtaining a

temporary restraining order to prevent the deal going through.

The Americans have described the prospective deal with NESV as an 'epic

swindle' and are seeking $1.6billion (more than £1billion) damages

against The Royal Bank of Scotland, Liverpool board members and NESV.

Despite the latest twist in the saga, Broughton is optimistic that the

sale will go through after accusing Hicks and Gillett of 'trying every

trick in the book'.

"They are trying every trick in the book, but keep the faith," Broughton

told Sky Sports News HD.

"We will keep trying. I haven't heard anything [this morning] I haven't

had time."

Asked if he remained confident of doing the deal with NESV, Broughton

added: "I always remain confident."

Liverpool are looking to remove the restraining order obtained by Hicks

and Gillett and they intend to complete the sale to NESV, with Henry

believed to be prepared to wait for the order to be lifted to conclude

the takeover.

OCTOBER 14

Reds respond to

injunction

Sky Sports

The temporary restraining order obtained by Liverpool

co-owners Tom Hicks and George Gillett in an attempt to stop a takeover

deal has been described as 'unwarranted and damaging' by the club's

directors.

The injunction was granted late on Wednesday night at a time when the

Premier League side's board, headed by chairman Martin Broughton, was

discussing a 'resolved' sale with John Henry's New England Sports

Ventures in London.

Hicks and Gillett lost a High Court case against the Liverpool hierarchy

and major creditors Royal Bank of Scotland on Wednesday morning, but

they say they have been granted the restraining order by a Texas court.

The Anfield board are unimpressed by the actions of the American duo,

who are also claiming more than £1billion in damages and have branded

the proposed sale to Henry as an 'epic swindle', with a hearing date set

for 25th October.

Deadline

Liverpool said in a statement on their official website on Wednesday

night: "Following the successful conclusion of High Court proceedings

today, the boards of directors of Kop Football and Kop Holdings met

tonight and resolved to complete the sale of Liverpool FC to New England

Sports Ventures.

"Regrettably, Thomas Hicks and George Gillett have tonight obtained a

Temporary Restraining Order from a Texas District Court against the

independent directors, Royal Bank of Scotland PLC and NESV to prevent

the transaction being completed.

"The independent directors consider the restraining order to be

unwarranted and damaging and will move as swiftly as possible to seek to

have it removed.

"A further statement will be made in due course."

It was hoped by all associated with Liverpool that Henry's takeover

would be concluded on Wednesday in order to give ample time to meet

Friday's deadline to repay a debt in the region of £230million owed to

RBS, which could push the club into administration.

Uncertainty

Liverpool confirmed on 5th October that they had accepted a bid from

NESV and that the sale would clear all acquisition debt, but the

agreement was subject to the High Court challenge from Hicks and Gillett

and Premier League approval.

Three days later RBS secured a temporary injunction preventing Hicks or

Gillett making any changes to the board after the co-owners attempted to

sack managing director Christian Purslow and commercial director Ian

Ayre.

With Premier League approval having been granted, Hicks and Gillett

attempted to challenge the sale and RBS's repayment deadline in the High

Court, claiming that Broughton, Purslow and Ayre had not considered all

offers.

Singapore businessman Peter Lim added to the uncertainty by submitting

an improved £320m bid, while Mill Financial, the then owners of

Gillett's 50% share after he defaulted on a loan, also expressed an

interest.

But on Wednesday morning Mr Justice Floyd granted a High Court

injunction that opened the way for the prompt sale of the club and led

to the meeting at One Bunhill Row in London, with NESV also claiming

they had a binding agreement.

OCTOBER 13

Hicks and Gillett claim

injunction to halt Liverpool sale

guardian.co.uk

Liverpool's American owners, Tom Hicks and George

Gillett, have tonight claimed that a Texas court has granted a temporary

restraining order stopping the proposed sale of the club to the owners

of the Boston Red Sox, calling the attempt to sell the club an "epic

swindle".

Hicks and Gillett claim they will sue the three Liverpool board members,

the bank controlling the club's debt and prospective buyer New England

Sports Ventures for a total of $1.6bn (£1bn) in damages. The pair said

that NESV's offer to buy Liverpool was "hundreds of millions of dollars

below true market value".

The statement came while NESV's John W Henry was meeting the three

English board members in central London to ratify the sale.

Earlier today a high court judge definitively ruled against Hicks and

Gillett in a move that was expected to precipitate the sale of the club

as early as tomorrow.

OCTOBER 13

Experts say Lim bid

too late for Liverpool

tribalfootball.com

Experts are convinced Liverpool will sell to NESV.

Financial expert David Buik of BGC partners believes there is no way

Liverpool will not be sold to NESV.

Yesterday's improved bid from Peter Lim had raised some uncertainly over

whether the takeover process was as cut and dried as it seemed.

But Buik believes Friday's upcoming deadline for the repayment of the

RBS loan means time is of the essence and there is no time to carry out

due diligence on another offer.

Buik told Sky Sports News: "It is done and dusted. Martin Broughton has

played a blinder, he was an inspired appointment by Barclays Capital to

look after their interest and RBS' interests.

"There has been plenty of time for another predator to put their money

on the table. The club was going cheap and he (Lim) has put his money

down slightly better but it is far too late.

"They have to deal with this matter. Liverpool cannot afford to go into

administration. This deal has to be done, it has been clean and the

sooner it is done the better.

"If there is anyone that could realistically show an improved amount of

money, time is not on their side. To do due diligence and for everyone

to be satisfied with October 15 on the horizon there is no chance (of

any else completing a takeover).

"There was only one winner of this thing and that was RBS. They are 83%

government-owned, they are not in a position to allow a loan of that

magnitude to default. They can foreclose on Liverpool but there is no

chance of that as they understand the culture of the Liverpool people

and what they need is stability."

OCTOBER 13

NESV claim

agreement reached

By Chris Burton - Sky Sports

New England Sports Ventures (NESV) claim to have a

binding agreement to buy Liverpool Football Club.

The American company, who own the Boston Red Sox baseball team, have

seen a £300million takeover bid accepted by the Anfield board.

They have, however, had to wait on the outcome of a High Court ruling

before being able to take that interest further.

An announcement on Wednesday that Liverpool have been cleared to push

through a takeover, against the wishes of current co-owners George

Gillett and Tom Hicks, has now opened the door to new investors.

NESV, who are fronted by John W Henry, are widely accepted to be leading

the chase but a rival bid from Singapore billionaire Peter Lim has cast

that deal into doubt.

Step forward

The Asian tycoon is promising to pay more for the club, while he has

also outlined his plans for the January transfer window - with

£40million to be made available for new players.

The Liverpool board are set to discuss both bids at a meeting on

Wednesday evening, with chairman Martin Broughton revealing as he left

court that no approach had yet been rubber-stamped.

NESV, however, claim to have already reached an agreement and were

waiting on the result of the courts case before finalising a deal.

"NESV welcomes today's High Court judgment, which is a huge step forward

for Liverpool FC," said a statement from the Boston-based limited

liability company.

"NESV has a binding agreement in place with the board of Liverpool FC

and we are looking forward to concluding the deal.

"We are ready to move quickly and help create the stability and

certainty which the club needs at this time. It is time to return the

focus to the club itself and performances on the pitch."

Best option

While NESV consider themselves to have one foot in the Anfield

boardroom, Lim has urged the Liverpool hierarchy to give due

consideration to his offer, as he remains keen to lead the club into an

exciting new era.

He said in a statement: "I welcome the decision of the court.

"I hope that when the board is reconstituted tonight that it will not

simply ratify a sale to NESV but will consider all the offers before

them.

"I am asking the board to run a full and fair process that enables all

of the offers to be considered on their merits before the future of the

club is decided.

"I have delivered my offer to the board and believe that my ownership

represents the best option for the future of the club and its

supporters."

OCTOBER 13

Purslow declares LFC

“back to business”

This is Anfield

Liverpool Managing Director Christian Purslow says it

is “back to business” after today’s court judgement ruled in favour of

the club and the Royal Bank of Scotland.

Current owners Tom Hicks and George Gillett were told they did not have

the power to remove Purslow and Commecial Director Ian Ayre from the

club’s board, and so the board may sell the club to who they wish.

Purslow said after the hearing at London’s high court, “RBS were granted

a mandatory injunction which effectively means that the removal of Ian

Ayre and myself was not valid and the board is exactly what it was

before the Owners sought to do that.

“We are absolutely delighted at this result. We can now get back to the

business, as a board, of looking after our football club and that’s what

we are going to do.

“We will consult with our legal teams and will make further

announcements in due course. But it’s back to business. ”

The board are expected to meet early this evening to make a decision on

which bid for the club to accept.

New England Sports Ventures is expected to be named the new owner of the

club within days.

OCTOBER 13

Reds

uncertainties

remain on the pitch

TEAMtalk

TEAMtalk warns Liverpool supporters that they still

face a "long and winding road" back to the top despite Wednesday's High

Court verdict.

The unpopular pairing of Tom Hicks and George Gillett may not be the

only losers from the changes now being proposed at Liverpool.

The cheers from fans outside the High Court in London when they learned

that Mr Justice Floyd had cleared the way for the sale of the club,

spoke volumes for their support.

But while they may have finally rid themselves of the duo, they have no

guarantees that the incoming owners will provide them with the real

salvation they crave and deserve.

The High Court imposed injunctions on the club's owners that allows the

£300million takeover by New England Sports Ventures (NESV), owners of

the Boston Red Sox baseball team, to be completed.

However, while the financial future is potentially brighter for the

club, there is still much work to be done where it matters - on the

pitch.

It is a matter of some conjecture whether the proposed change of

ownership will have been met with much cheer by the club's current

manager Roy Hodgson.

Hodgson is just three months into his reign at Anfield and is already

under fire following a dismal start to the season.

The club sit in Barclays Premier League relegation zone and were bundled

out of the Carling Cup by Northampton.

The new owners, if reports are to be believed, could exercise a

compensation clause worth around £3million, and replace Hodgson with

their own man.

Hodgson is clearly a talented manager, given his success at Fulham, but

he already looks out of his depth on Merseyside.

Although chairman Martin Broughton insists that the new owners are

committed to Hodgson, how long will that remain so if the team continues

to show no sign of upward progress?

NESV must act cautiously but back their words with actions because much

of Liverpool's full recovery will depend on the building of a new

60,000-seater stadium.

Hicks and Gillett lost the trust of the fans when they failed to "put a

spade in the ground" within 60 days of their takeover.

Anfield's stadium development or the building of an entirely new one has

been a major issue during discussions with NESV and the success of

Liverpool's future will depend on what happens in that area.

A debt-reduced Liverpool will only become a major power again with a new

stadium and under UEFA's financial fair-play ruling due to commence in

two years, when clubs must break even over a rolling three-year period

to qualify for European competition, the need for stability has suddenly

become even more acute.

RBS may have emerged triumphant from today's High Court hearing and

Liverpool fans may have won their biggest victory of the season so far,

but there are many more battles to come.

Some of these may not be as easy to sweep aside and the new owners will

need to show they are not just here to boost their own bank balances.

That means undertaking stadium development, giving the manager the

spending power he requires and making ends meet.

Hicks and Gillett may have lost the club and their money, but there will

be more at stake in the future. It is indeed going to be a long and

winding road for the fans.

OCTOBER 13

Reds board to

discuss bids

By Chris Burton - Sky Sports

Martin Broughton has revealed that the Liverpool board

will meet to discuss all bids for the club on Wednesday evening.

The Reds chairman was speaking as he left the High Court following a

ruling which has paved the way for a takeover of the club to be put in

place.

Current co-owners George Gillett and Tom Hicks had hoped to block a move

for control at Anfield, with the offers on the table falling short of

their valuation.

However, with the club's creditors, the Royal Bank of Scotland, looking

to recoup a £237million loan by a deadline set for 15th October, Mr

Justice Floyd has sided in favour of Liverpool and RBS.

Discussions with interested parties can now begin in earnest, with the

Reds keen to get new owners in place as soon as possible, allowing them

to clear their debts and focus their attention on matters on the field.

It was believed that a £300million bid from John W Henry's New England

Sports Ventures was the preferred choice of the Liverpool board, with

that offer having already been accepted.

However, a rival bid from Singapore billionaire Peter Lim has left the

Reds facing a quandary.

Lim has promised £320m in cash and a £40m transfer kitty for the January

transfer window.

Chairman Broughton has confirmed that there is no guarantee that NESV

will be successful in their efforts, with the Liverpool board yet to sit

down and discuss the latest developments.

Excellent outcome

"The board will be properly reconstituted by eight o'clock this evening,

that was the judge's order, and proceed with the sale process," he told

Sky Sports News.

"This will clear the way for a sale, but I'm not going to prejudge the

board meeting. It would be inappropriate to prejudge what the board is

going to say.

"But the club's going to have a great future. We will re-establish the

right basis for the club.

"The acquisition debt that has been plaguing us will be gone, we have a

great future. We will get the right owners for the fans."

While keen to steer clear of takeover talk for now, Broughton is

delighted with Wednesday's ruling which has given the board power to

negotiate a sale.

He said: "It was an excellent outcome. We have been confident all along.

We think we have done the right thing. When you go to court, though, you

can never pre-judge it."

Broughton admits he is disappointed that Gillett and Hicks felt the need

to take proceedings as far as they did, but is pleased that progress can

now be made.

He added: "I am disappointed that they have acted in this way, to try

and breach the undertakings they gave me. But up until then they have

supported the process."

OCTOBER 13

High Court rules

against Hicks and Gillett

TEAMtalk

A High Court judge has ruled against Liverpool

co-owners Tom Hicks and George Gillett, paving the way for a takeover of

the club by NESV.

Hicks and Gillett asked a judge to delay the hearing of an application

by creditors Royal Bank of Scotland (RBS) for mandatory orders paving

the way for a possible sale this week.

But the plea was rejected by Mr Justice Floyd, sitting at the High Court

in London.

At RBS's request, the judge imposed injunctions on the two men requiring

them to restore the original constitutions of the companies and managing

directors.

This removes the final stumbling block to a £300million takeover by New

England Sports Ventures (NESV), which will see the RBS recoup its

original £237million loan to Mr Hicks and Mr Gillett when they bought

the club in March 2007.

Mr Justice Floyd rejected applications by the owners for an injunction

to halt the sale negotiations until they had attended a board meeting

and there be further discussions over any sale agreement.

"I am not prepared to grant any relief," he said. "If I did it would

risk stopping the sale and purchase agreement going ahead."

He said this would result in potential serious damage to the club and

RBS.

Yesterday the judge heard Hicks had tried to block the NESV deal last

week by removing managing director Christian Purslow and Ian Ayre from

the board of the Liverpool Football Club companies.

He had then installed his son, Mack, and business associate Lori

McCutcheon so that he had control of voting on the board before a

meeting to decide on which bid to accept for the sale of the club.

But this was in breach of agreements the Americans signed with the bank

when RBS extended it credit facilities.

The RBS loan facility ends on Friday and the bank had applied to the

court for the injunction to allow the sale to go ahead and recoup its

money.

The owners were refused permission to appeal.

The judge said it would be "inappropriate in the circumstances" for him

to grant leave, and they would have to apply to the appeal court for

permission.

Keith Oliver, a senior partner with solicitors Peters & Peters, who are

acting for Mr Hicks and Mr Gillett, said an appeal was not being ruled

out.

Mr Oliver said: "We are obviously disappointed with the judge's

decision.

"Mr Hicks and Mr Gillett will now be considering their next steps, and

that will include whether to make an application to the court of

appeal."

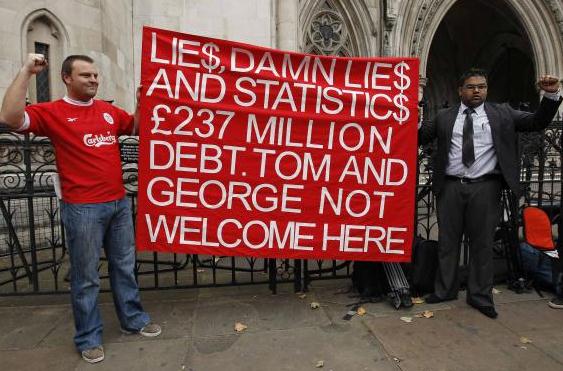

There were chaotic scenes outside the Royal Courts of Justice in the

Strand when more than 100 Liverpool fans mobbed club chairman Martin

Broughton, singing: "We love you, Martin, oh yes we do."

Security guards tried and failed to move the crowd blocking the entrance

as they broke into the Liverpool anthem You'll Never Walk Alone.

Lord Grabiner QC, who represented the companies controlling the club,

put the costs of the action at between £250,000 and £500,000.

Broughton described himself as "elated" with the result but stopped

short of saying that the club will definitely be sold to John Henry's

New England Sports Ventures.

Broughton said nothing is guaranteed ahead of a meeting that will be

held tonight with a reconstituted board.

Singapore business tycoon Peter Lim tabled an improved £320million bid

yesterday and Broughton, who was appointed in April to oversee the sale

of the Anfield club, will wait to see what the outcome of tonight's

meeting is before endorsing either bid.

He told Sky Sports News: "I am absolutely elated, it's a very important

day for our club.

"This will clear the way for the sale, we will have a board meeting this

evening and proceed with the sale.

"It has been an anxious time but we have been confident. But when you go

to court you can never be sure."

Regarding the sale to NESV, Broughton added: "The board has to be

reconstituted and I can't prejudge what the board is going to say. It

would be inappropriate to prejudge what the board may say.

"I want to thank the fans for their support through a difficult time. We

hope to have the board meeting this evening. We will get the right

owners for the fans.

"It was an excellent outcome and I will be very pleased when the process

we came in to do is completed."

A statement on the club website said: "We are delighted that the court

has clarified the issue of board composition and has removed the

uncertainty around the sale process.

"We will now be consulting with our lawyers and planning for a board

meeting tonight. A further statement will be made in due course."

LFC fans protest outside the High Court. (Photo: Reuters)

OCTOBER 12

Liverpool and RBS wait on high-court

decision after day of drama

By Owen Gibson - guardian.co.uk

Liverpool's fate will be decided by a high- court

judge tomorrow morning after a dramatic day of evidence on which two

rival offers emerged to the one that has been accepted by the club's

board.

As lawyers for the current co-owners, Tom Hicks and George Gillett,

argued against those representing the club and its principal lender, the

Royal Bank of Scotland, inside court and fans demonstrated outside, it

also emerged that:

• The Singaporean billionaire Peter Lim had made an improved offer that

was instantly relayed to the court. It is worth £320m in cash, plus £40m

for transfers.

• Mill Financial, the US hedge fund understood to have assumed control

of Gillett's stake in the club after he defaulted on a loan, was also

said to be interested in buying the club and was said to have offered to

clear Liverpool's debts and commit up to £100m to building a new

stadium.

• Hicks and Gillett had launched a counter-claim against the Liverpool

board and RBS in an attempt to slow down the process and postpone the

club's proposed £300m sale to New England Sports Ventures, the owners of

the Boston Red Sox.

After a full day of sometimes spiky exchanges and dense legal argument

Mr Justice Floyd told a packed courtroom that he would return tomorrow

morning to deliver his verdict.

RBS and Liverpool's independent chairman, Martin Broughton, who was

brought in by the bank to oversee the sale of the club, are confident

that their claim for breach of contract will succeed. The bank is

seeking a ruling that Hicks and Gillett breached a contract that was

signed when they refinanced in April, giving Broughton the power to

appoint the board and effective control of the sale process.

In giving evidence Hicks admitted for the first time that the

undertakings given to RBS were breached when he and Gillett attempted to

dissolve the board and reconstitute it with directors favourable to

their cause. However his QC, Paul Girolami, argued that they had no

choice because they had been frozen out of the sale process by

Broughton, the chief executive, Christian Purslow, and the commercial

director, Ian Ayre.

Richard Snowden QC, representing RBS, accused Hicks of "breathtaking

arrogance" and said that it was "as clear a breach of contract as you

will ever see".

He repeatedly tried to return to the nub of the claim – RBS's insistence

that the breach of contract should be reversed and the club's board

reconstituted, to allow the sale to proceed. Hicks, in his evidence,

suggested that the "English directors", who he said secretly referred to

themselves as the "home team", had kept information from Gillett and

himself and rushed through a sale to NESV when other parties would pay

more.

He said: "What has happened is that the English directors have gone

forward with the NESV bid without properly considering alternatives when

those alternatives at least appear to give better prospects."

The suggestion that Hicks and Gillett were frozen out was rubbished by

Lord Grabiner QC, acting for the club, and Snowden. The "home team"

reference was merely shorthand for the board in sale negotiations, they

said.

Philip Marshall QC, acting for the club on company law issues, said the

board had narrowed down a field of 130 inquiries – from which 27 firm

expressions of interest had arisen – with the advice of Barclays Capital

and had accepted the best offer.

Mill Financial is said to have £400m in liquid equity and to have

offered to clear the club's debts, inject working capital and invest in

a new stadium. But lawyers for the club said its interest had gone no

further once it knew it could not enter into exclusive negotiations.

Lim's public release of a letter sent to the Liverpool board, as court

proceedings began, could be seen to aid the argument of Hicks and

Gillett. "I believe that, if its massive debt burden can be removed, the

club would be able to focus on improving its performance on the pitch,"

said Lim. "If the board accepts this offer, the monies are available

immediately thereby removing the threat of administration."

It was also confirmed for the first time that RBS is owed 75% of the

outstanding £237m loan and the rest is owed to Wells Fargo. There is

also at least £40m in fees outstanding. RBS argued that a speedy

judgment was crucial because the loans are due to be repaid on Friday.

Girolami argued that the threat of administration was an empty one

because the bank had other instruments at its disposal.

NESV has until 1 November to complete its deal. RBS said it wanted a

return on its loan and it was up to Liverpool whether it reactivated the

auction process. Lawyers for NESV said in court it would seek damages if

the deal fell apart.

The club is seeking its own declaratory judgment to allow the sale to

proceed, which it launched last night. This could become superfluous if

the decision goes the way of RBS tomorrow.

"The next 72 hours are crucial. Whichever side Mr Justice Floyd comes

down on, the matter will not end with his decision. There are a number

of subplots that still need to be played out before Friday, and beyond.

Indeed, should the court rule that the board are entitled to sell, then

it will have to give due consideration to Mr Lim's bid, should the due

diligence prove it to be viable," said Andrew Nixon, a partner at Thomas

Eggar LLP Sports Group.

"The apparently pre-agreed deal with NESV, and NESV's rights to enforce

any agreement, could then come under the spotlight. Further, in the

event that the sale proceeds, and Hicks and Gillett remain of the view

that the Club has been sold at undervalue, they may consider bringing a

claim for damages against the board."

OCTOBER 12

Broughton

expects court victory

Sky Sports

Liverpool's independent chairman Martin Broughton

remains confident of winning the High Court battle regarding the

ownership of the club despite the judgement being delayed until

Wednesday morning.

A ruling on the case was expected on Tuesday afternoon, as current

co-owners Tom Hicks and George Gillett attempt to block a proposed sale

to New England Sports Ventures, who have seen a £300million offer

accepted by the club's board.

Hicks and Gillett's lawyers are also disputing Friday's deadline for the

repayment to major creditor Royal Bank of Scotland (RBS) of a £237m

debt.

As a result, Mr Justice Floyd has decided to make his judgment at

10.30am on Wednesday, which leaves Liverpool fans anxiously awaiting the

decision on the future of the Premier League club.

But Broughton, who agreed the sale against the wishes of Hicks and

Gillett, is optimistic.

He told Sky Sports News when leaving court on Tuesday evening:

"Judgement reserved, I'm not allowed to say anything. But we remain

confident.

"For everybody it is nerve-wracking. But we will find out at 10.30

tomorrow."

OCTOBER 12

Peter Lim submits increased

£360m offer to buy Liverpool FC

By David Bartlett - Liverpool Echo

Singapore billionaire Peter Lim has submitted an

increased offer for Liverpool Football Club for £360m.

Mr Lim’s offer has been sent to chairman Martin Broughton today as a

court is deciding whether he has the legal powers to force through a

sale to New England Sports Venture. Liverpool FC has already stated it

will honour the deal struck with New England Sports Ventures.

The proposal values the club at £320m.

In a statement today, Mr Lim - who narrowly lost out to NESV - said the

new offer is entirely in cash and will remove the entire acquisition

debt of £200m taken on by the existing owners that has cast uncertainty

over the club’s future.

The new offer includes a cash investment of £120m – £40m for new players

in the January transfer window and £80m to pay off all the club’s bank

debt, the fees and interest accruing on the bank debt, and provide

additional working capital for the club.

The offer also assumes that Mr Lim would take on £40m of liabilities,

making the total offer worth £360m.

Mr Lim said he is not obtaining any financing for the offer and the

funding comes from his own cash resources.

Today Mr Lim said: “I respect and admire Liverpool Football Club, which

is steeped in tradition and history.

“I am committed to rebuild the club so that it can soon regain its

position at the pinnacle of English and European football, where it

truly belongs. This is why I have stepped forward with this offer.

“I believe that if its massive debt burden can be removed, the Club

would be able to focus on improving its performance on the pitch.

“My offer pays off the existing owners’ bank acquisition debt and also

frees the club of its own bank debt. If the board accepts this offer,

the monies are available immediately thereby removing the threat of

administration.

“The club needs to strengthen its existing squad. As part of this offer,

I will be injecting £40m in cash into the Club for Roy Hodgson to bring

in new players during the upcoming transfer window. Liverpool needs to

start winning again!

“My offer provides a firm financial platform from which the club can

rebuild. Given the manner in which the sale process has been handled, I

feel Martin and the Board owe it to me, to the Club, and to the

supporters, to consider my offer."

OCTOBER 11

Liverpool to receive new bid

from Singapore billionaire

By Robert Peston, Business editor - BBC News

The bidding contest for Liverpool FC may not be over,

the BBC can reveal.

The runner-up in the contest, Peter Lim, a Singapore billionaire, is to

approach Liverpool's board with a view to making a higher offer for the

club.

According to sources close to Mr Lim, he was the club's preferred bidder

in the closing stages of the auction.

He had talks with Liverpool's chairman about how to announce his

takeover, such was the apparent confidence that he would win the

contest.

Mr Lim learned he was not the victor only a few hours before the club's

chairman, Martin Broughton, announced on 6 October that Liverpool would

be sold to John Henry's New England Sport Ventures for £300m.

Mr Lim, who is being advised by the British firm of lawyers Macfarlanes

and by the Wong Partnership of Singapore, still does not know why Mr

Broughton went with New England Sports Ventures, owners of the Boston

Red Sox.

He believes that in purely monetary terms, his offer was at least as

attractive as Mr Henry's.

Mr Lim, too, was offering to repay all of Royal Bank of Scotland's and

Wachovia's £200m of long-term debt, to take on £60m of other debt and to

inject £40m of working capital.

What's more - and Mr Lim regards this as crucial - all the money being

provided by him would come from his own cash resources. He is not

planning to borrow any of it.

I understand he is also offering to provide tens of millions of pounds

to Liverpool's manager, Roy Hodgson, to allow him to buy players when

the transfer window opens in January.

According to executives close to Mr Lim, he was told by Mr Broughton

that his ability to fund the takeover for cash, and the size of his cash

resources, meant he was a more attractive owner than New England Sports

Ventures.

Mr Lim was told that Liverpool's board was concerned that New England

Sports Ventures would have to borrow to finance the takeover - raising

questions about whether Liverpool really would break free from the

financial shackles perceived to have been imposed by the current owners,

George Gillett and Tom Hicks.

In the event, New England Sports Ventures have insisted it will not load

up Liverpool FC with debt.

But there are no guarantees that there will not be significant debt

further up the corporate ownership structure of New England Sports

Ventures - which could limit how much money Mr Henry and his colleagues

can inject into Liverpool in the future.

Mr Lim is keeping a close eye on the court case, which starts on

Tuesday.

The case is supposed to rule on whether Mr Broughton can sell Liverpool

to New England Sports Ventures against the wishes of Mr Hicks and Mr

Gillett.

The Singapore billionaire believes the judgement in that case may give

him an opportunity to bid again, whatever Mr Broughton may wish.

Mr Lim is also prepared to buy Liverpool, should it ultimately collapse

into administration under UK insolvency procedures.

According to sources close to him, he feels that he may have been shut

out because New England made an offer to Royal Bank of Scotland to pay

some of the £40m penalty fees the banks have demanded.

If that is the case, he believes Royal Bank may have done a poor deal,

because he would be prepared to pay RBS and Wachovia more than the £10m

or so which New England Sports Ventures is said to have put on the

table.

"He never had a chance to negotiate directly with Royal Bank [of

Scotland]," said a source. "He was expecting to do so, after agreeing

the takeover with the board."

Mr Lim has an estimated net worth of $1.6bn (£1bn), according to Forbes

Magazine.

He made his fortune in fashion, logistics and agri-business.

His interest in English football stems from his ownership of several

Manchester United themed bars in Asia - which have persuaded him that

there is huge global potential for making money from top-flight English

football.

Meanwhile, Royal Bank of Scotland announced on Monday afternoon that it

had obtained an injuction to prevent Liverpool owners Tom Hicks and

George Gillett from sacking Martin Broughton or any other of the club's

board members ahead of Tuesday's court case.

OCTOBER 11

Bank blocks Reds board changes -

Hicks can't sack Broughton, Purslow & Ayre

Sky Sports

The Royal Bank of Scotland have won an interim

injunction preventing Liverpool co-owners Tom Hicks and George Gillett

from firing chairman Martin Broughton and two other board members.

As the ownership row at Anfield prepares to go to the High Court on

Tuesday RBS have revealed they have won an injunction that prevents the

American owners from sacking independent chairman Broughton, managing

director Christian Purslow and commercial director Ian Ayre.

Hicks tried to remove Purslow and Ayre from Liverpool's board last week

after the duo along with Broughton agreed the club's club to New England

Sports Ventures

The deal is being opposed by Hicks and Gillett who have brought the case

to the High Court to try and prevent the sale to NESV.

RBS, which holds the bulk of Liverpool's debt is claiming "breach of

contract" and says it obtained an interim injunction ahead of a further

hearing on Tuesday at London's High Court.

RBS said in a statement: "RBS in its capacity as lender to the Kop group

of companies received the benefit of various contractual undertakings

from Mr Hicks and Mr Gillett in relation to the corporate governance

arrangements that Mr Hicks and Mr Gillett agreed would apply to the Kop

group of companies with effect from April 2010.

"Those undertakings provided for the appointment of Mr Broughton as

chairman of the board and the appointment of the chief executive and

commercial director of LFC to the Kop boards.

"As is well known Mr Hicks and Mr Gillett purported to make changes to

those corporate governance arrangements on 4 October. This was in breach

of those contractual undertakings.

"In light of that purported breach of contract RBS sought and obtained

on Friday 8 October 2010 an interim injunction against Mr Hicks and Mr

Gillett until a further hearing scheduled for tomorrow.

"Among other things, that interim injunction prevents Mr Hicks or Mr

Gillett taking any steps to remove or replace Mr Broughton from his

position as chairman of the board of the Kop companies or from taking

any other steps to appoint or remove any directors from the board of the

Kop companies."

Broughton insists he had the right to sell the club to NESV as Hicks and

Gillett had signed agreements not to oppose the sale when they received

an extension to their refinancing deal with Royal Bank of Scotland

earlier this year.

The Premier League is understood to be ready to approve the sale and, if

the NESV deal goes through, Hicks and Gillett stand to lose a total of

£144million.

It is feared, however, if Hicks and Gillett win the High Court battle,

that Liverpool could be placed into administration and docked nine

points if RBS decide to call in the £237m acquisition debt owed, due for

payment in full on Friday 15th October.

OCTOBER 11

Liverpool in

court - what next?

TEAMtalk

With Liverpool facing a crucial week in their history,

TEAMtalk looks at what the outcome of the High Court case could mean for

the club.

With Friday's deadline for owners Tom Hicks and George Gillett to repay

their £237million loan to Royal Bank of Scotland looming should the club

lose their legal battle there is a risk the bank could call in their

debt, resulting in administration.

That would run the real risk of a nine-point deduction being imposed by

the Premier League, leaving the Reds on minus three points heading into

Sunday's Merseyside derby.

Here TEAMtalk looks at what the outcome of the court case could mean for

the club.

- Should the High Court side with chairman Martin Broughton's view that

he and the England-based members of the board have acted in the best

interests of the club in agreeing a £300million deal with New England

Sports Ventures then, assuming an appeal is also unsuccessful, the sale

will go ahead and Liverpool will avoid any points deduction.

- Were Hicks and Gillett to triumph, an outcome which most observers

believe is unlikely, it would trigger a number of side issues.

a) RBS - The bank would have to make a decision on whether to call in

their loan on Liverpool's parent company Kop Holdings when it is due on

Friday or extend the deadline. If they opt for the former and the owners

do not have the finance to repay - which apparently they do not despite

attempts to try to raise cash through deals elsewhere - the Premier

League would then be required to rule on whether the club itself was in

administration. Although RBS are keen to recover their money they could

hold off going down the route of administration as if there was a

nine-point deduction it would lessen the value of the asset in which

their cash is tied up.

b) Premier League - Guidelines state insolvency at a holding company

will incur a points deduction unless the club themselves are solvent and

can demonstrate the insolvency is not caused by matters "relating to the

management of the football club". However, as the holding company was

set up by Hicks and Gillett solely to buy the club it may be difficult

to argue insolvency is not related to football matters. To highlight the

different situations, West Ham escaped punishment as their holding

company's insolvency was caused by the Icelandic financial crisis but

Southampton were docked points by the Football League as their holding

company had the club - which was insolvent - as its only asset.

c) NESV - Sources close to the potential new owners suggested over the

weekend a nine-point deduction would be a deal-breaker but it remains to

be seen whether that would be the case or whether they would try to

renegotiate a deal on better terms.

d) Other bids - Although NESV are the preferred option Broughton has

admitted there is another interested party based in Asia, believed to be

Singapore, who could be prepared to take advantage of any withdrawal

from the American group.

e) Hicks, who is now the major opponent to Broughton's boardroom

decision-making with Gillett having reportedly already defaulted on a

loan, could continue to pursue avenues for refinancing but this would be

even more difficult if there is a nine-point deduction to contend with.

His hope of finding a bidder willing to pay an asking price which will

prevent him and Gillett losing £144million in the NESV deal seems even

more fanciful.

OCTOBER 11

High Court defeat monumentally damaging

– but there is a plan B

This is Anfield

The prospect of Liverpool Football Club losing its

high court case against current owners Tom Hicks and George Gillett this

week could plunge the club into a monumental struggle on and off the

pitch.

Should Hicks and Gillett win the case, not allowing a £300million sale

of the club to New England Sports Ventures to go through, Liverpool’s

holding company Kop Holdings is likely to be put into administration

shortly after Friday’s deadline to repay £280million of loans to the

Royal Bank of Scotland.

The RBS would see administration as the only way to force a change in

power at the club, with victory for Hicks and Gillett in court meaning

they would have the power to change the Board of Directors.

Although the club itself would not technically be in administration, the

Premier League would likely impose a nine point deduction penalty. This

would leave Roy Hodgson’s men bottom of the table, on -3 points, with an

uphill battle to face.

And it gets worse…

Owen Gibson Guardian

“Sources close to the negotiations indicated that the position of John W

Henry and the rest of the NESV board has hardened further since

yesterday, when the Guardian revealed that they may walk away. The news

will dismay Liverpool fans, who hoped the ownership of Tom Hicks and

George Gillett was nearing an end. RBS is seriously considering

administration if a £237m loan to the club is not refinanced by Friday,

after its legal advisers warned it could leave itself open to a

challenge if it does not do so.”

Paul Kelso Telegraph

“NESV’s change in position comes after the Premier League told the

club board that a nine-point deduction was a “significant risk” even if

the administration occurred at Liverpool’s holding company Kop Football

(Holdings) Ltd.

“Royal Bank of Scotland, whose £237 million loans to Hicks and Gillett

via Kop Holdings becomes due on Friday, has indicated that if the court

rules against Broughton it might be forced put the company into

administration to effect a change of control. NESV’s threat to walk away

came as a surprise to RBS and the club board, and was interpreted by

several sources close to the negotiations as a positioning exercise. It

is also evidence of a marked deterioration in relations between John W

Henry’s group, the club board and RBS.”

However, there is a plan B…

Nick Harris The Independent

“But in all likelihood, the club won’t get anywhere close to

administration. One reason is that Broughton has what are being

described as “fallback” options (“a Plan B and Plan C”, says a source),

which he believes can force through a sale to NESV without

administration. The details of these are not known but would involve

convoluted legal mechanisms, with Royal Bank of Scotland probably

extending its nominal 15 October deadline while they were being played

out. These would only come into play if Broughton loses.

“In any case, given that RBS would ultimately trigger administration,

and that there is no logical benefit to RBS of Liverpool going into

administration, it is hard to see that Liverpool will end up there.

“Why? Because, with Liverpool in administration, RBS would no longer be

guaranteed to get all its money back; it would lose control of the

situation. Theoretically, it could end up with 20p in the pound or

similar.”

This is one of the biggest weeks in the club’s history, and certainly,

the biggest week in it’s future.

OCTOBER 10

Purslow expects

Liverpool

takeover to succeed

ITN

Liverpool chief executive Christian Purslow is

confident the proposed £300 million sale of the club to New England

Sports Ventures will go through.

Purslow maintained the Reds board had "done their homework" on the

American investment group, which owns the Boston Red Sox baseball team,

and said that the club's £237m debt would be wiped out if the takeover,

which is subject to a High Court challenge from current owners Tom Hicks

and George Gillett, goes through next week.

He also insisted manager Roy Hodgson's job was safe and that the

Liverpool fans would be given a voice should the new owners be able to

complete their takeover.

Hicks and Gillett borrowed money from the Royal Bank of Scotland to

complete their purchase of Liverpool in 2007, a debt which Purslow

insists would be wiped out by an NESV buy-out.

Purslow said: "My total priority has been to try to remove the debt

which has been put on this club and which has been a cloud since

February 2007.

"It is wrong that we should have so much of the money that comes through

the turnstiles or through our commercial activity go to pay interest on

loans."

He added: "A bidder who has been willing with cash to rid of us of all

this long-term debt is by far the largest and most important priority in

evaluating bids.

"We have done our homework and NESV are buying this business with cash

and clearing our debt which transforms our financial position

overnight."

Hicks and Gillett have launched a legal challenge to the takeover,

describing it as invalid and insisting that the offer by NESV

under-valued the club. The High Court case is set to begin on Tuesday.

If the court rules in favour of Hicks and Gillett, RBS could call in

their debt as early as Friday, when repayment is due in full, and force

Kop Holdings into administration.

That would almost certainly result in a nine-point penalty being imposed

on the club by the Premier League, which would leave them bottom of the

table on minus three points.

However, Purslow said: "I'm not even contemplating administration."

OCTOBER 9

Liverpool takeover: Nine-point

deduction may scupper £300m deal

Telegraph co.uk

Liverpool's prospective owners New England Sports

Ventures [NESV] may pull out of the proposed £300 million takeover if

next week's court case rules that the club must enter administration.

Liverpool’s proposed sale to NESV could break down because the American

company fears the club will be placed in administration and suffer a

nine-point penalty.

It has been reported that NESV is alarmed by the idea, having been given

assurances that it was an extremely unlikely scenario when the company

agreed a deal to buy the club.

Why would anyone want to buy Liverpool? It has also emerged that NESV

has consulted Rick Parry, the club’s former chief executive who

supported the takeover of Tom Hicks and George Gillett, over its bid.

John W Henry and Tom Werner, the principal figures behind NESV, met with

Parry in his capacity both as an expert on Liverpool and the Premier

League. The 55 year-old spent six years as the League’s inaugural chief

executive before working at Anfield and helped negotiate a then-record

£700m deal for TV rights with Sky.

Parry backed the Hicks-Gillett bid for Liverpool and is believed to have

received a bonus of about £500,000 for helping complete the sale. He

left the club in May last year.

A nine-point penalty, which could be imposed next Friday, would add

further pressure on Roy Hodgson's team, which remains fourth from

bottom, giving the club a total of minus three points, eight points

behind the two clubs above, West Ham United and Wolves.

OCTOBER 9

Broughton

admits admin fears

Sky Sports

Liverpool chairman Martin Broughton admits the club

could end up in administration next week.

The Reds' future will be decided in the High Court on Tuesday, as

Broughton battles with the club's owners George Gillett and Tom Hicks

over the proposed sale of the club to New England Sports Ventures.

Broughton was hired by Hicks and Gillett earlier this year as club

chairman, with his main job being to find a new owner.

He has now set up a £300million sale to NESV, but Hicks and Gillett are

not happy with the price and are now taking the issue to court.

If Hicks and Gillett win their case, then Broughton says the club could

very well go into administration as the club's main financial backers,

Royal Bank of Scotland, are due to call in their debt of £280million on

15th October.

Should RBS call in their debts, then that would see Liverpool enter

administration which would also see a nine-point deduction in the

Premier League.

"It [administration] could happen, yes," Broughton told the Daily

Telegraph.

"This is all part of why it is important that we made the decision on

Tuesday to accept one or the other of the two very acceptable bids.

Heading for administration was a very likely outcome if we didn't.

"Even now with the court case looming, administration cannot be ruled

out. It is not inevitable, and I am not going to start giving

percentages of how much it is possible. That is why we are going to

court to clarify our position on the sale of the club, and we have to

win in court, and we will win in court."

Broughton admits the consequences of administration would be

'catastrophic'

"Going into administration needs to be avoided at all costs, as the

negative impact would be catastrophic," he said.

"Setting aside the nine-point deduction, it would have an impact on

Liverpool's value and be wide open to predators, whereas we have what we

believe is the right new owners to take the club forward."

Should Hicks and Gillett fail, NESVs takeover could be completed shortly

afterwards as their proposed directors, John W Henry and Tim Werner,

have been cleared by the Premier League to take control of the club

under its Owners and Directors test.

OCTOBER 8

Premier League back

Liverpool take-over

RTE

The Premier League have given the go-ahead to New

England Sports Ventures (NESV)'s takeover of Liverpool.

The green light to the takeover by the American company, owners of the

Boston Red Sox, means that only the High Court action by current owners

Tom Hicks and George Gillett stands in the way of the £300m deal going

through.

The league said in a statement: 'The Premier League has met with the

owners and directors of NESV regarding their proposed takeover of

Liverpool FC and has received details, in accordance with Premier League

rules, of the proposed company and ownership structure as well as the

make-up of the new board.

'The Premier League is satisfied, with the information provided, that

the individuals NESV intend to put in place in the event they complete

their takeover of Liverpool FC meet the criteria set out in our owners'

and directors' test.

'The board of the Premier League will continue working with Liverpool FC

in regard to this process, however, we are aware that the formal

completion of this takeover is yet to be resolved and it is therefore

inappropriate for us to offer any further comment at this time.'

If the takeover is not completed by next Friday then the Royal Bank of

Scotland could put Kop Holdings, the company owned by Hicks and Gillett,

into administration over their unpaid £280million debt.

If that happens, Liverpool would be at risk of a nine-point deduction.

Initially it had been thought the Premier League would not penalise the

club for Kop Holdings becoming insolvent, but now the threat of a points

deduction has become a serious one.

Under Premier League rules, the fact that the holding company is solely

concerned with the ownership of Liverpool and football-related matters

could trigger the nine-point penalty.

West Ham had been used as an example of why the Reds might escape in

deduction if administration goes ahead when it was owned by Icelandic

bank Straumur.

The Hammers, however, were a solvent part of a whole portfolio of

different companies while Kop Holdings is solely concerned with

Liverpool.

OCTOBER 8

Liverpool could

face points deduction

By Dan Roan - BBC sports news correspondent

Liverpool are likely to face a nine-point deduction if

its parent company Kop Holdings goes into administration next week, BBC

Sport understands.

League rules say a points deduction can be used if a parent company

insolvency is caused by the club's management.

Sources suggest owners Tom Hicks and George Gillett would struggle to

argue that the running of the football club had not affected the holding

company.

Liverpool could enter administration if a sale is not agreed by 15

October.

If Hicks and Gillett manage to block a £300m takeover of the club by New

England Sports Ventures (NESV), owners of the Boston Red Sox baseball

team, their holding company could be put into administration by the

Royal Bank of Scotland over their £280m debts.

The Premier League board of chief executive Richard Scudmore, chairman

Sir Dave Richards and secretary Mike Foster would then decide whether to

dock points.

Liverpool are already in the bottom three of the Premier League after a

dismal start to the season with just six points from their opening seven

games.

Initially it was thought that the club would avoid a sporting penalty,

but the club now faces the very real possibility of a deduction if a

sale to NESV is delayed.

And it is now thought that Hicks and Gillett could find it hard to argue

that the football club had not had a negative impact on Kop Holdings,

especially when the club is the parent company's sole asset.

Liverpool's fate rests on the outcome of a declaratory judgement in the

High Court on a date yet to be decided next week over whether the club

can be sold to NESV despite the objection of the club's owners.

An appeal is likely regardless of the result, with no outcome likely

before the 15 October refinancing deadline set by RBS, the club's major

creditor. RBS will have the choice to waive their demand for repayment

until the legal dispute is finalised, or call in the debt and place the

parent company into administration.

Portsmouth became the first Premier League club to enter administration

earlier this year and automatically received a nine point reduction,

condemning it to relegation.

Liverpool is solvent and has been used to service Kop Holdings' debts,

while in a similar case, West Ham avoided a penalty when its holding

company went into administration last year. However, the club was just

one of several interests in the portfolio of by Straumur, the Icelandic

bank.

Meanwhile, John Henry and the other directors of NESV are expected to

pass the league's new 'owners and directors' test, making official

approval of the takeover a formality.

OCTOBER 8

Broughton

eyes

profitable future

Sky Sports

Liverpool chairman Martin Broughton has aimed a swipe

at Manchester City, saying his club's prospective new owners will

provide a profitable future at Anfield.

The Reds have agreed in principle to sell the club to New England Sports

Ventures, but co-owners Tom Hicks and George Gillett are trying to block

the deal.

The takeover battle is set to be resolved in the High Court next week

with Liverpool hopeful a deal with NESV, who also own the Boston Red

Sox, will be pushed through.

Broughton believes prospective new owner John Henry will provide

'rational' leadership at Liverpool and that the club will be in position

for the new Uefa fair play regulations, which are set to come into

effect in 2012.

"A hugely important aspect for Liverpool is [Uefa's] financial fair play

rules. They come into effect pretty damn soon, and will have a massive

effect on many, many clubs," Broughton said.

"Taking a rational, commercial approach to success is absolutely the

right way forward, and that is what New England will do. They have

demonstrated that already in their model at Boston.

Wage bill

"I couldn't help notice that Manchester City's wage bill for last year

was exceeding its revenue. That is going to be very difficult under

financial fair play. They might be able to sort it out before then but

we were not looking for someone who was going to put us in that

position.

"We were looking for somebody who was going to see this as a commercial

business that can be commercially successful. That is what they have

already demonstrated. They have made a profit by investing heavily in

players and stadium development and they have delivered a winning team."

Broughton insists NESV's approach is the right one for the future and

that funds will be made available to bolster the playing ranks.

Balance

Broughton added: "We weren't looking for an Abramovich or Sheikh

Mansour, because we understand a rational commercial approach is the way

forward in football now.

"New England's bid of around £300m will include £200m in equity to write

down the acquisition debt, as we call it, the legacy of Hicks and

Gillett, and there is £40m of cash to pay off various other liabilities.

"The balance is what we call assuming the ongoing working capital debt

and the new stadium financing debt, and it means there will be no debt

on the club, and Liverpool will actually be equity rich. The aim was

always zero debt.

"Why? Because that will allow trading without debt, and vast profits

coming available again to invest in the business instead of servicing

loans. New England are fully committed to that, they are committed to

investing heavily in players and infrastructure to boost future

profits."

Thor Zakariassen ©